Executive Briefing: Media |

|

|

|

_

Additional Insights: U.S. Consumer Insights:

|

|

Insights from the ProsperChina™ Quarterly survey of over 16,000 Chinese Consumers ages 18-54 provide unique knowledge to identify opportunities in the evolving Chinese marketplace. Visit the ProsperChina.com website.

Talking Points:

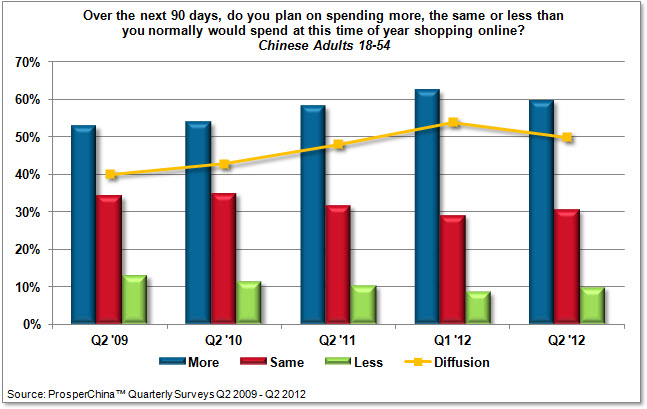

- Though e-commerce is booming, online shopping plans decline

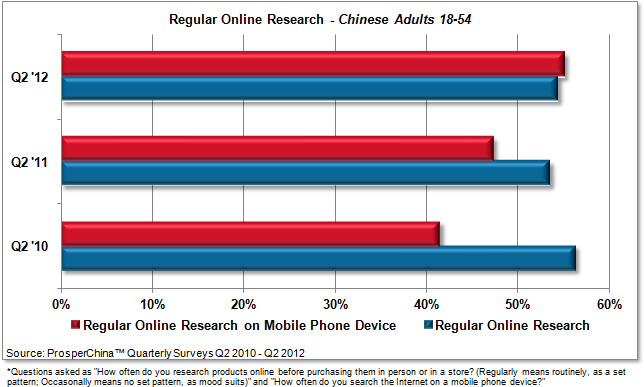

- China’s mobile evolution continues: more research, more users

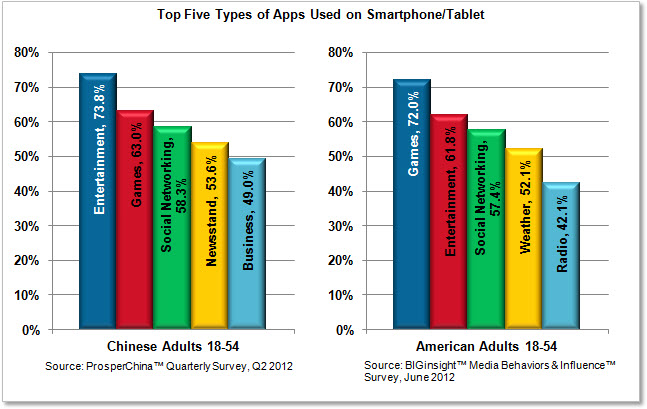

- App downloads: China vs. U.S.

- Social networking here to stay

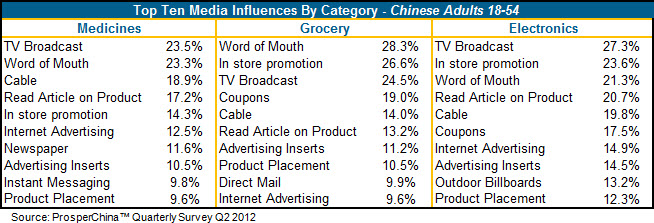

- What influences consumers’ pharmaceutical, grocery, and electronics purchases?

| e-commerce Outlook |

While China’s e-commerce sector continues to boom, it appears that Chinese Consumers are pulling back on their online shopping plans this quarter amidst a shaky 90 day retail spending outlook and dampening consumer sentiment...59.7% plan to spend “more” by shopping online this quarter than they would normally spend this time of year vs. 62.4% who planned to spend more last quarter. However, according to the ProsperChina™ Diffusion Index (the percentage of consumers planning to spend more over the next 90 days minus the percentage planning to spend less), consumers’ online spending intentions have generally been on the rise for the past three years:

Also illustrating consumers’ growing love of online shopping is the rising number of consumers indicating they “regularly” shop online...in Q2 2012, 56.6% say they regularly head to the web to make purchases, up from 52.9% in Q2 2011 and 46.3% in Q2 2010. As the website used most often for buying products online among 7 in 10 (69.5%) Chinese Consumers, Taobao.com is set to benefit from this growing trend.

| Online Research |

Astute marketers should also take note that Chinese Consumers are likely to head to the Internet to research products and services before purchasing them in person...over half (54.4%) of Chinese Adults 18-54 indicate they regularly research online, and another 39.9% occasionally do so. Even more noteworthy, though, is China’s mobile search evolution...in Q2, 55.1% of consumers are doing regular research on their mobile phone, up more than 30% from just two years ago:

Need more proof that the “mobile way” is here to stay? Recent reports from the China Internet Network Information Center show that mobile Internet users now surpass desktop users – largely due to users in rural areas of China who depend on their phones to access the Internet.

For more complementary insights on how e-commerce and mobile are revolutionizing shopping in China, download the ProsperChina™ Tablet App, install the Apple Web App or register for the online ProsperChina™ InsightCenter™| Social Media |

As the number of Internet users in China (currently well over 500 million) continues to grow, the Internet and China’s various social media sites are transforming personal connections in China. 65.5% of adults 18-54 now regulalry use Qzone, up 6.2% quarter-over-quarter. 42.9% regulalry use Sina Weibo, while 36.3% regulalry use rival Tencent Weibo. Youku also remains popular, with 37.4% regulalry using the site. For more social media insights, click here.

| Mobile Engagement |

Along with research and shopping, more than 3 in 4 (79.8%) Chinese Consumers download apps to their smartphones and tablets. Interestingly though, top app categories differ among Chinese and American Adults ages 18-54. While Chinese Consumers include newsstand and business apps in their top five, American consumers are more apt to check the weather or tune into the radio with their app of choice:

| Media Influence |

As one of the toughest places for foreign brands to succeed, developing the optimal media mix is critical for companies trying to reach Chinese Consumers. But, media influence differs by both the target consumer and the retail category: